Inherited ira minimum distribution calculator

Use oldest age of multiple beneficiaries. If you simply want to withdraw all of your inherited money right now and pay taxes you can.

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Use our IRA calculators to get the IRA numbers you need.

. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD. The SECURE Act of 2019 changed the age that RMDs must begin. Use this worksheet to figure this years required withdrawal from your non-inherited traditional IRA UNLESS your spouse 1 is the sole beneficiary of your IRA.

Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Calculate your earnings and more. For IRA distributions see Publication 590-B Distribution from.

RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. Reduce beginning life expectancy by 1 for each subsequent year. RMD amounts are based.

The distributions are required to start when you turn age 72 or 70 12 if you were born before 711949. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Eligible designated beneficiaries can stretch distributions from inherited IRAs indefinitely beginning in the year after the death of the IRA owner and calculate the RMD using the IRSs.

Note that the minimum is different for spouses and non-spouse beneficiaries. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

In 2019 Congress changed the rules for required minimum distributions RMDs from inherited individual retirement account IRA and employer-sponsored account balance retirement plans by requiring distributions to most beneficiaries to occur within 10 years after the death of an IRA owner or plan participant. This calculator has been updated to reflect the new figures. Required Minimum Distribution Calculator.

Ad Inherited an IRA. Calculate the required minimum distribution from an inherited IRA. Schwab Can Help You Through The Process.

Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Learn More About Inherited IRAs. Distribute using Table I.

1231 of the year following the year of death. When the decedent would have attained age 72 or. But if you want to stretch the IRA proceeds and.

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Your life expectancy factor is taken from the IRS.

Find a Dedicated Financial Advisor Now. Use this calculator to determine your Required Minimum Distribution RMD. Required Minimum Distribution Worksheet - for everyone else.

You transfer the assets into an Inherited IRA held in your name. A Free Calculator To Help You Find Out How Much You Have. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Required Minimum Distribution Worksheet - use this only if your spouse is the sole beneficiary of your IRA and is more than 10 years younger than you. Also note that inherited Roth IRA withdrawals are not subject to any tax if the Roth. Paying taxes on early distributions from your IRA could be costly to your retirement.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. These amounts are often called required minimum distributions RMDs. Ad Inherited an IRA.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. The SECURE Act changes the distribution rules for beneficiaries of account owners who pass away in 2020 and beyond. Ad Use This Calculator to Determine Your Required Minimum Distribution.

Distribute using Table I. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution.

You can also explore your IRA beneficiary withdrawal. Account balance as of December 31 2021. Required Minimum Distributions RMDs are mandatory and you have the option to postpone distributions until the later of.

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. But if you want to defer taxes as long as possible there are certain distribution requirements with which you must comply. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA.

Revised life expectancy tables for 2022 PDF Important calculator assumptions. This calculator has been updated for the SECURE Act of 2019 and CARES Act of 2020. Learn More About American Funds Objective-Based Approach to Investing.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. Determine the required distributions from an inherited IRA. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

1 The statutory change simply modified what had. If inherited assets have been transferred into an inherited IRA in your name this calculator may help determine how much may be. If you were born before 711949 the age remains 70 12.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. If you want to simply take your inherited. The IRS has published new Life Expectancy figures effective 112022.

Can take owners RMD for year of death. Determine beneficiarys age at year-end following year of owners death. Use this calculator to provide a hypothetical projection of the required minimum distributions for you and your beneficiary.

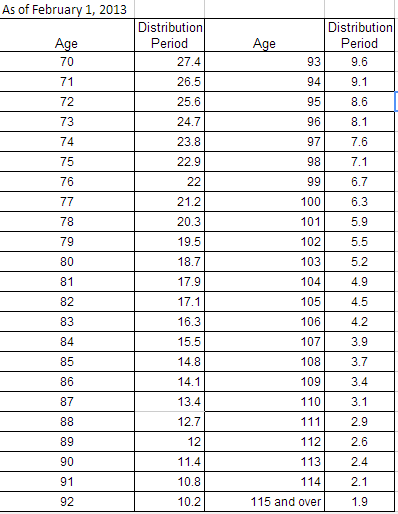

If you were born on or after 711949 your first RMD will be for the year you turn 72. How is my RMD calculated. 36 rows This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy table.

It is the simplest most straightforward of all possible models by emulating. Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary.

Required Minimum Distributions Rules Heintzelman Accounting Services

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Required Minimum Distribution Rules Sensible Money

Rmd Calculator Required Minimum Distributions Calculator

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Rmd Table Rules Requirements By Account Type

Required Minimum Distribution Calculator

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

Learn How To Calculate Online Advertising Rates To Make Money Blogging Inherited Ira Blog Advertising Money Blogging

Ira Required Minimum Distribution Table Sound Retirement Planning

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Required Minimum Distribution Calculator Estimate Minimum Amount

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type